Premier Members Credit Union: Your Path To Financial Well-being

In today's complex financial landscape, finding a partner who truly understands your needs and puts your interests first is paramount. This is precisely where Premier Members Credit Union stands out. Offering a comprehensive suite of financial services for individuals and businesses in Boulder and surrounding areas, PMCU is dedicated to making your financial life easier. By joining Premier Members Credit Union, you gain access to low rates, exceptional service, and outstanding products designed to help you achieve your monetary goals with confidence and ease.

Unlike traditional banks, Premier Members Credit Union operates on a unique model: it serves its members, not just customers. This fundamental difference means that every decision, every product, and every service is crafted with the singular purpose of enhancing your economic well-being. From secure online banking to a wide array of savings and loan options, PMCU is committed to being your trusted financial ally, deeply rooted in the communities it serves across Colorado.

The Premier Difference: Members First Philosophy

At the core of Premier Members Credit Union’s operations is a philosophy that truly sets it apart: putting members first. This isn't just a slogan; it's the guiding principle that shapes every interaction and decision. As a credit union, PMCU proudly serves "members, not customers." This distinction is vital because it means the institution is owned by its members, not by external shareholders. Consequently, profits are reinvested back into the credit union to benefit members through lower fees, better rates on loans and savings, and enhanced services.

The very existence of Premier Members Credit Union is rooted in a clear mission: "to provide our members an opportunity to improve their economic well-being." This commitment extends beyond mere transactions; it's about fostering financial literacy, offering guidance, and creating pathways for members to achieve their personal and business financial aspirations. This member-centric approach builds a foundation of trust and reliability, essential elements when managing your hard-earned money. It’s a financial institution where your success is their success, and that shared vision drives their dedication to exceptional service and support for local communities.

A Legacy of Trust and Growth: The Premier Members Story

Premier Members Credit Union is not just another financial institution; it is a federally insured state-chartered credit union deeply embedded in the financial landscape of Colorado. This status provides a robust layer of security and oversight, ensuring that your deposits are safe. Specifically, accounts are federally insured up to $250,000 by the National Credit Union Administration (NCUA), offering peace of mind for every member.

The credit union's journey has been marked by strategic growth and a commitment to expanding its reach and capabilities. A significant milestone occurred in 2015 when Premier Members Credit Union and Boulder Valley Credit Union joined forces in a "merger of equals." This strategic alliance created a new, stronger credit union operating under the established Premier Members Credit Union brand. This merger brought together shared values and a combined dedication to serving their communities, enhancing the financial services available to an even wider member base.

Today, Premier Members Credit Union stands as a formidable financial entity, headquartered in Broomfield, Colorado. Its impressive scale is a testament to its trusted services and member loyalty. With assets exceeding $1.7 billion, 19 branches strategically located across Colorado, and a dedicated team of nearly 300 employees, PMCU serves a vibrant community of over 78,000 members. These figures not only reflect the credit union's stability and strength but also its capacity to deliver comprehensive financial solutions while maintaining its personalized, member-first approach. This strong foundation allows them to consistently put their 78,000 members first, ensuring reliable and expert financial guidance.

Comprehensive Financial Solutions for Every Need

Whether you're planning for retirement, saving for a down payment, or seeking flexible credit options, Premier Members Credit Union offers a diverse portfolio of products designed to meet a wide spectrum of financial needs. Their commitment to providing outstanding products ensures that members have access to the tools necessary to achieve their financial aspirations.

Savings and Deposit Accounts: Building Your Future

Saving money is a cornerstone of financial security, and Premier Members Credit Union understands that every individual's savings journey is unique. That's why they offer a comprehensive range of savings and deposit accounts tailored for every need. From basic savings to specialized accounts, PMCU provides options that help your money grow faster and more securely.

- Money Market Accounts: For those looking for more from their savings, Premier Money Market accounts offer competitive rates, allowing you to get closer to your savings goals faster. If you're seeking even higher returns on larger balances, the new Jumbo Money Market from PMCU is designed to maximize your earning potential. These accounts provide liquidity while offering better interest rates than traditional savings accounts.

- IRAs (Individual Retirement Accounts): Planning for the future is crucial, and PMCU offers various IRA options to help you build a comfortable retirement nest egg. These tax-advantaged accounts are essential tools for long-term financial planning.

- Share Certificates (CDs): For those who can set aside funds for a fixed period, share certificates offer guaranteed returns at competitive rates. When you join Premier Members Credit Union, you’ll be eligible for some of the best rates on CDs, providing a secure way to grow your savings.

- Youth Savings Accounts: Instilling good financial habits early is vital. PMCU provides youth savings accounts, designed to educate younger members about saving and managing money responsibly, setting them up for a lifetime of financial success.

When you join Premier Members Credit Union, you'll find that eligibility for lower fees and some of the best rates extends not just to loans and CDs, but also to these valuable money market savings accounts, making your savings work harder for you.

Loans and Credit: Achieving Your Goals

Life's big moments often require financial assistance, and Premier Members Credit Union is there to provide flexible and affordable loan options. Whether you're buying a home, purchasing a car, or consolidating debt, PMCU offers a variety of loan products designed with your financial well-being in mind.

Members benefit from lower fees and some of the best rates on loans, making borrowing more affordable. For instance, the rate on a line of credit is subject to change monthly on the 1st day of the month, based on the Wall Street Journal Prime Rate plus your qualifying margin. This transparent and competitive rate structure ensures that members understand their borrowing costs clearly. PMCU's lending solutions are crafted to help you achieve your personal and business goals, providing the financial leverage you need with terms that prioritize your economic stability.

Unparalleled Convenience: Banking On Your Terms

In today's fast-paced world, access to your finances needs to be seamless and immediate. Premier Members Credit Union understands this necessity and has invested significantly in technology and infrastructure to provide unparalleled convenience, ensuring you can manage your money whenever and wherever you are.

24/7 Digital Access: Online & Mobile Banking

Imagine having your financial life at your fingertips, accessible any time of day or night. With Premier Members Credit Union's online and mobile services, this vision becomes a reality. You can manage your finances 24/7 from wherever you are, whether at home, at work, or on the go.

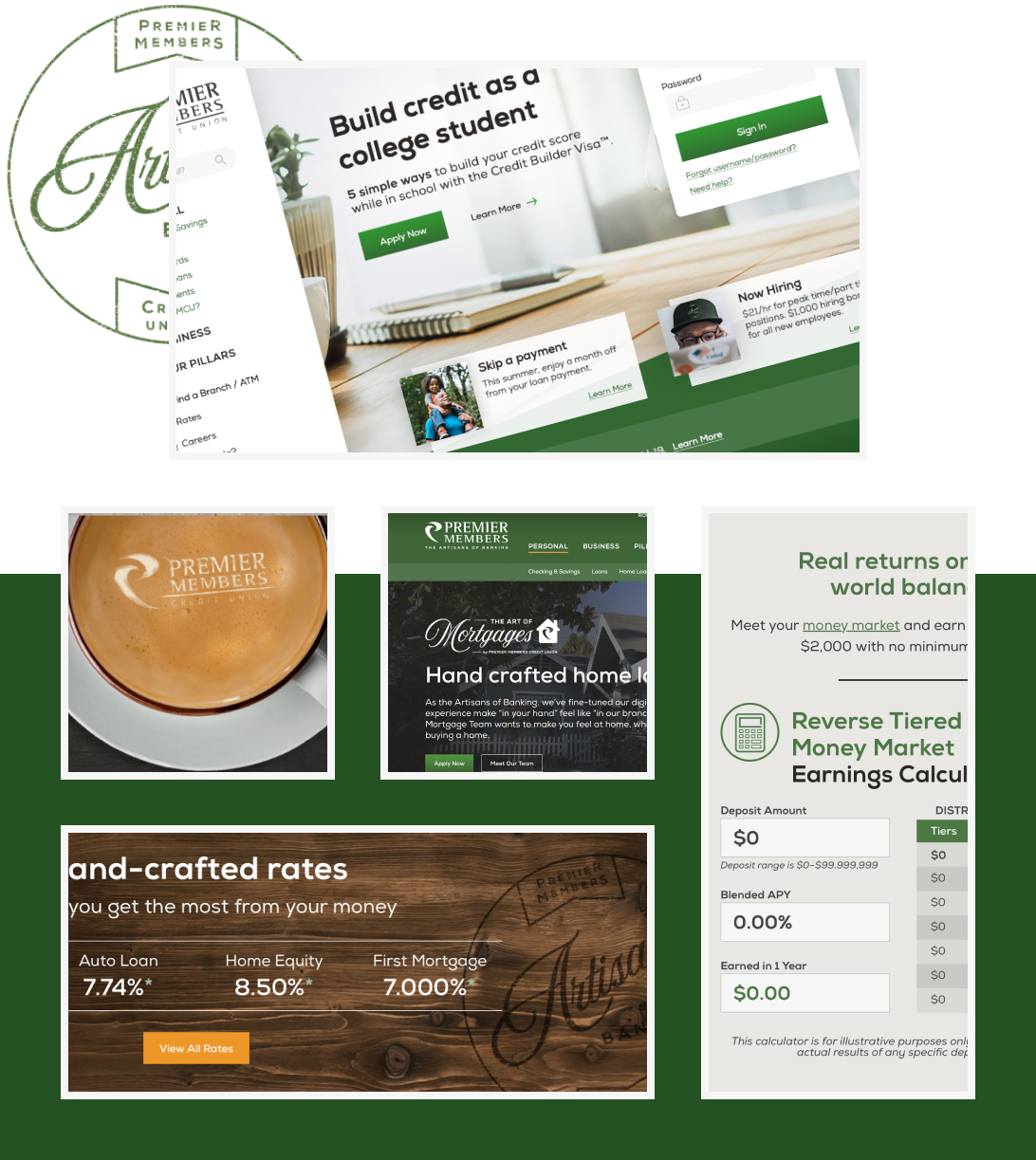

Enjoy secure access to your Premier Members CU accounts 24 hours a day with their free online banking service. All you need is a personal computer, an internet connection, and your password. The beauty of this system is its direct connection to the credit union, meaning all your transactions take place immediately. This real-time processing capability ensures that payments, transfers, and account inquiries are handled swiftly and efficiently. For mobile users, the new apps are named "Premier Members Credit Union" (formerly Premier Members Mobile), providing a streamlined and intuitive experience. Should you encounter any issues, such as being redirected to the mobile website without full functionality, simply try adjusting your screen resolution for optimal performance. This dedication to robust digital services underscores PMCU's commitment to modern, convenient banking.

Extensive Branch and ATM Network

While digital banking offers incredible flexibility, sometimes you need the personal touch of a branch or the convenience of an ATM. Premier Members Credit Union ensures that physical access is just as easy. You can readily find a branch, ATM, or shared branch near you, thanks to their extensive network.

This network isn't limited to just their own locations. Premier Members Credit Union participates in a shared branching network, allowing members to conduct transactions at thousands of credit union branches across Colorado and the U.S. This means you can learn about the services and fees available at different locations, providing a vast network of accessible financial services, no matter where your travels take you. This blend of digital and physical access truly puts banking on your terms, making Premier Members Credit Union a highly accessible choice for your financial needs.

Investing in Our Communities: More Than Just Banking

Premier Members Credit Union’s commitment extends far beyond offering competitive rates and convenient services; it’s deeply rooted in the communities it serves. "PMCU is based right here in Colorado and we invest in our communities every day." This statement highlights a fundamental aspect of their identity as a credit union. Unlike large commercial banks that may prioritize global profits, PMCU focuses on local impact.

This investment takes many forms, from supporting local businesses and non-profits to sponsoring community events and promoting financial literacy within schools. Their dedication to serving and supporting local communities is not just a corporate social responsibility initiative; it's an integral part of their mission to improve the economic well-being of their members, who are also their neighbors. By choosing Premier Members Credit Union, you're not just selecting a financial institution; you're supporting an organization that actively contributes to the vibrancy and prosperity of your local area. This community-first approach fosters a sense of shared purpose and collective growth.

Exceptional Service: Always Here When You Need Us

The foundation of any strong financial relationship is trust, and trust is built on reliable, responsive service. At Premier Members Credit Union, the phrase "we put members first" isn't merely a corporate slogan; it's a daily practice embodied by their staff. "That’s why we’re always here when you need us." This commitment translates into a genuine desire to assist members with their financial queries and needs, ensuring a smooth and supportive experience.

The credit union prides itself on its warm and friendly staff, who are dedicated to providing personalized attention. Whether you have a complex loan question, need assistance with online banking, or simply want to understand your account options, the team at PMCU is ready to help. They offer a full range of financial products, complemented by countless services built to provide their membership with everything they need.

Reaching out to Premier Members Credit Union is straightforward. You can browse their online resources to find what you need, or contact them directly. For mail correspondence, you can send inquiries to: Premier Members Credit Union Attn: Retail Operations, 360 Interlocken Blvd, Broomfield, CO 80021. When sending correspondence, it's always advisable to include your name, account number, and loan suffix information to ensure prompt and accurate assistance. This accessibility and dedication to service ensure that there's no limit to what they can do for you in managing your financial life.

Why Choose Premier Members Credit Union?

When considering where to place your trust for financial services, the choice of Premier Members Credit Union becomes clear for several compelling reasons. It’s not just about having an account; it’s about partnering with an institution that prioritizes your financial health and future.

Firstly, the tangible benefits of membership are significant. As a member, you’ll be eligible for lower fees and some of the best rates on loans, CDs, and even money market savings accounts. These competitive rates mean more money stays in your pocket, whether you're borrowing or saving. This direct financial advantage is a hallmark of the credit union model, where member benefit trumps shareholder profit.

Secondly, the exceptional service and outstanding products are designed to truly make your financial life easier. From the intuitive 24/7 online and mobile banking services that allow you to manage your finances from anywhere, to a comprehensive network of branches and shared ATMs across Colorado and the U.S., convenience is paramount. The full range of financial products, including various savings accounts (money market, IRA, share certificates, youth savings) and flexible loan options, ensures that every financial need is addressed with expertise.

Finally, and perhaps most importantly, is the underlying philosophy: "we put members first." This commitment is evident in every aspect of Premier Members Credit Union's operations. Their dedication to improving members' economic well-being, their investment in local communities, and their warm, friendly staff who are always there when you need them, create a banking experience built on trust and genuine care. This unique blend of financial advantage, unparalleled convenience, and a deeply rooted community focus makes Premier Members Credit Union an outstanding choice for anyone seeking a true financial partner.

Conclusion

In summary, Premier Members Credit Union represents a powerful combination of financial strength, community commitment, and member-focused service. From its robust federal insurance and impressive asset base to its wide array of savings, deposit, and loan products, PMCU is equipped to support every stage of your financial journey. The convenience of 24/7 online and mobile banking, coupled with an extensive branch and shared ATM network, ensures that managing your money is always within reach.

Choosing Premier Members Credit Union means opting for an institution that truly puts your economic well-being first, offering lower fees, competitive rates, and a dedicated team ready to assist. If you're seeking a financial partner that aligns with your values and actively works to make your financial life easier, we encourage you to explore the benefits of membership. Visit their website, contact their friendly staff, or stop by a branch to discover how Premier Members Credit Union can help you achieve your financial goals and experience banking that truly makes a difference. Your path to improved financial well-being starts here.

Premier Members Credit Union – Lee Architects

Premier Members Credit Union - Sketchfolio

Premier Members Credit Union Centennial | AD Miller Construction Services