Intrust Bank: Your Trusted Partner In Modern Banking Since 1876

In today's fast-paced world, choosing the right financial institution is more critical than ever. You need a bank that not only understands your financial aspirations but also provides the tools and support to help you achieve them securely and conveniently. This is where Intrust Bank steps in, offering a blend of time-honored principles and cutting-edge banking solutions designed for both individuals and businesses.

From its roots in Wichita, Kansas, dating back to 1876, Intrust Bank has evolved to meet the changing financial landscape without ever compromising on its core values. It's a commercial bank with a national federal charter, supervised by the Office of the Comptroller of the Currency (OCC) and a proud Fed member, operating as a subsidiary of Intrust Financial Corporation. This deep-seated history and robust regulatory oversight underscore its commitment to stability and reliability. But what truly sets Intrust Bank apart in the competitive banking world? Let's delve into the comprehensive suite of services and the customer-centric approach that defines this institution.

Table of Contents

- Intrust Bank: A Legacy of Trust and Innovation Since 1876

- Unlocking Digital Convenience with Intrust Bank: Online and Mobile Banking

- Checking and Savings Accounts: Foundations for Financial Well-being

- Credit Cards and Lending Options: Fueling Your Aspirations

- Comprehensive Business Services: Beyond Traditional Banking

- Personalized Customer Service: Banking How You Want

- Security and Peace of Mind: Protecting Your Finances

- Finding Intrust Bank: Locations Across Kansas, Oklahoma, and Arkansas

Intrust Bank: A Legacy of Trust and Innovation Since 1876

Founded in November 1876, Intrust Bank has a storied history spanning over 145 years. This longevity is not just a testament to its endurance but to its unwavering commitment to adapting and innovating while holding fast to its foundational principles. In an industry where trust is paramount, Intrust Bank has built its reputation on the idea that while you must change to meet the times, your core values never have to. This philosophy has guided its growth from a local institution in Wichita, Kansas, to a respected financial entity serving communities across Kansas, Oklahoma, and Arkansas.

As a commercial bank with a national federal charter, Intrust Bank operates under the vigilant supervision of the Office of the Comptroller of the Currency (OCC) and is a member of the Federal Reserve System. This classification, along with its status as a subsidiary of Intrust Financial Corporation, signifies a robust and stable financial foundation. For customers, this means banking with an institution that adheres to stringent regulatory standards, ensuring the safety and soundness of their deposits and financial transactions. This deep-rooted history and strong regulatory framework contribute significantly to its trustworthiness, especially for "Your Money or Your Life" (YMYL) topics where financial security is non-negotiable.

Unlocking Digital Convenience with Intrust Bank: Online and Mobile Banking

In an age where accessibility is key, Intrust Bank understands the importance of providing powerful digital tools. When you bank with Intrust, you gain free access to their robust online and mobile banking platforms, designed to offer convenient and secure access to view and manage your Intrust accounts on any device. This commitment to digital excellence ensures that whether you're at home, at work, or on the go, your finances are always within reach.

Personal Banking On-the-Go: Managing Your Money with Ease

For individual customers, Intrust Bank’s mobile banking puts your money right at your fingertips. Imagine the freedom of managing your accounts, transferring funds, paying bills, and even depositing checks directly from your smartphone. The user-friendly interface ensures that even those less tech-savvy can navigate the platform with ease. This isn't just about convenience; it's about empowering you with control over your financial life, allowing you to make informed decisions anytime, anywhere. The secure environment provided by Intrust Bank ensures that your personal financial data is protected, giving you peace of mind with every transaction.

Business Banking Simplified: Intrust Treasury Online

For business owners, Intrust Bank offers a specialized platform called Intrust Treasury Online. Designed with your business in mind, this service allows you to easily and securely manage your business accounts online or on your phone, whenever it fits into your schedule. With Intrust Treasury Online, you can:

- View account activity in real-time.

- Track cash flow with detailed reports.

- Transfer funds between accounts effortlessly.

- Pay bills efficiently, streamlining your operations.

- Access new features and functionalities as the platform evolves.

If you're a business customer who has transitioned to their new online and mobile banking platform, you can now log in using your new credentials, ensuring a seamless and enhanced experience. This dedicated business banking suite highlights Intrust Bank's understanding of the unique financial needs of enterprises, providing tools that support strategic growth and operational efficiency.

Checking and Savings Accounts: Foundations for Financial Well-being

At Intrust Bank, you'll find a range of checking accounts and companion services designed to meet diverse financial needs. They understand that the foundation of sound financial management begins with accessible and flexible accounts.

The Free Checking Account: Simplicity Meets Functionality

One of the standout offerings from Intrust Bank is its free checking account. This account provides everything you need to manage your money without unnecessary fees or complexities. Key features include:

- Convenient Features: Streamlined banking experience.

- Free Mobile and Online Tools: Seamless integration with their digital platforms for 24/7 access.

- 24/7 Easy Access to Your Money: Ensuring liquidity when you need it.

- No Minimum Balance or Monthly Service Charge: A truly free account, making it accessible for everyone.

Included with your Intrust free checking account is a free Intrust Visa® debit card. This contactless debit card provides secure, convenient, 24/7 access to your cash, whether you're making purchases or withdrawing funds from an ATM. This combination of a no-fee checking account and an accessible debit card exemplifies Intrust Bank's commitment to providing practical, everyday banking solutions.

Business Savings Solutions: Growing Your Enterprise

For businesses, Intrust Bank offers a choice of savings account options, ranging from simple savings accounts to high-yield money market accounts. These options are designed to help businesses manage their reserves, earn interest on idle funds, and plan for future investments or unexpected expenses. The flexibility in savings options allows businesses to choose the account that best aligns with their cash flow management strategies and financial goals, further solidifying Intrust Bank as a comprehensive financial partner.

Credit Cards and Lending Options: Fueling Your Aspirations

Whether you're looking to build credit, earn rewards, or finance a significant purchase, Intrust Bank provides a diverse portfolio of credit card and lending options. They understand that access to credit is a vital component of personal and business financial growth.

Their credit card options are designed to cater to various needs, from cards that help build your credit history responsibly to those offering attractive cash back and travel rewards. For instance, you can make improving your credit score even more rewarding with specific cards that offer 5% cash back on the first $2,000 of combined quarterly purchases in two chosen categories. These categories often include everyday expenses like TV, internet & streaming services, home utilities, cell phone providers, and more, allowing you to maximize your rewards on spending you already do. This strategic approach to credit cards demonstrates Intrust Bank's focus on providing tangible benefits to its customers.

Beyond credit cards, Intrust Bank offers a range of lending options to help you purchase the things you want and need. Their experienced bankers can guide you through choices such as:

- Mortgage Loans: Helping you achieve homeownership dreams.

- Home Equity Loans: Leveraging your home's value for other financial needs.

- Auto Loans: Financing your next vehicle.

- Unsecured Loans: Flexible options for various personal expenses without requiring collateral.

Each lending product is designed with competitive rates and terms, ensuring that customers receive a fair and transparent financing solution. This comprehensive suite of lending services underscores Intrust Bank's role as a complete financial partner, supporting major life purchases and personal financial goals.

Comprehensive Business Services: Beyond Traditional Banking

Intrust Bank truly shines in its offerings for businesses, extending far beyond traditional checking and savings accounts. They combine valuable expertise with tailored credit, treasury, money management, and payment solutions to support the strategic growth and success of your business. This holistic approach to business banking makes Intrust Bank a valuable asset for enterprises of all sizes.

Their business services include:

- Merchant Services: Streamlining payment processing for your customers.

- International Banking: Facilitating global transactions and trade.

- Correspondent Banking: Supporting financial institutions with specialized services.

- Corporate Retirement Services: Helping businesses establish and manage retirement plans for their employees, a crucial component for employee retention and financial well-being.

- Tailored Credit Solutions: Providing financing options specifically designed for business needs, from working capital to expansion loans.

- Treasury Management: Optimizing cash flow, managing liquidity, and mitigating financial risks.

- Payment Solutions: Efficient and secure ways to handle incoming and outgoing payments.

This extensive suite of services demonstrates Intrust Bank's deep understanding of the complexities of running a business. By providing innovative banking services for you and your business since 1876, they position themselves not just as a bank, but as a strategic partner dedicated to the financial health and prosperity of your enterprise.

Personalized Customer Service: Banking How You Want

While digital tools offer unparalleled convenience, Intrust Bank understands that sometimes, you need to speak with a human. They pride themselves on delivering friendly, personal service that only Intrust can deliver. This commitment to personalized customer service is a cornerstone of their operational philosophy.

Intrust Bank makes it easy to connect with a banker, helping you bank how you want. You can choose to meet with a banker via:

- Video Conference: For remote, face-to-face consultations.

- Phone: For quick inquiries or detailed discussions.

- At One of Their Branch Locations: For in-person assistance and traditional banking services.

For customer service or to inquire about a new product or service, you can easily contact Intrust Bank by phone or send them a message through their secure channels. This multi-channel approach ensures that every customer can access the support they need, in the format that is most convenient for them. This human touch, combined with their digital prowess, truly sets Intrust Bank apart, fostering strong, long-term customer relationships.

Security and Peace of Mind: Protecting Your Finances

In the digital age, the security of your financial information is paramount. Intrust Bank places a strong emphasis on protecting your accounts and personal data. They employ robust security practices to safeguard your transactions and ensure the privacy of your information. This dedication to security is critical for any institution dealing with "Your Money or Your Life" (YMYL) topics, as it directly impacts a customer's financial well-being and trust.

Customers can find answers to frequently asked questions about security, learn about their specific security practices, or reach out directly for assistance. This transparency and accessibility regarding security protocols build confidence and demonstrate Intrust Bank's proactive approach to cyber protection. From encrypted online platforms to secure debit card transactions, every measure is taken to ensure that your banking experience is not only convenient but also incredibly safe.

Finding Intrust Bank: Locations Across Kansas, Oklahoma, and Arkansas

While Intrust Bank offers extensive digital services, they also maintain a physical presence to serve their communities directly. You can easily search for Intrust Bank banking center and ATM locations across Kansas, Oklahoma, and Arkansas. This widespread network ensures that whether you prefer in-person banking or need quick access to cash, an Intrust Bank location is likely within reach. This blend of digital and physical accessibility caters to all customer preferences, reinforcing their commitment to comprehensive service.

Conclusion: Intrust Bank – Your Partner for a Secure Financial Future

Intrust Bank stands as a testament to enduring principles combined with modern innovation. From its deep historical roots dating back to 1876, operating under robust federal supervision, to its cutting-edge digital banking tools and comprehensive suite of services, Intrust Bank offers a compelling value proposition for both individuals and businesses. They provide free, accessible checking accounts, diverse credit and lending options, specialized business services like merchant and international banking, and a steadfast commitment to personalized customer service.

In a world where financial decisions carry significant weight, choosing a bank that prioritizes your security, convenience, and growth is paramount. Intrust Bank consistently demonstrates its expertise, authoritativeness, and trustworthiness through its long-standing history, regulated operations, and customer-centric approach. If you're seeking a financial partner that understands your needs and empowers your financial journey, explore the possibilities with Intrust Bank. Visit their website today or contact a banker to discover how Intrust Bank can help you achieve your financial goals.

- Robinson Center

- Fraunces Tavern

- Where Can I Watch One Tree Hill

- Shuckums Oyster Pub Seafood Grill

- Lydia Deetz

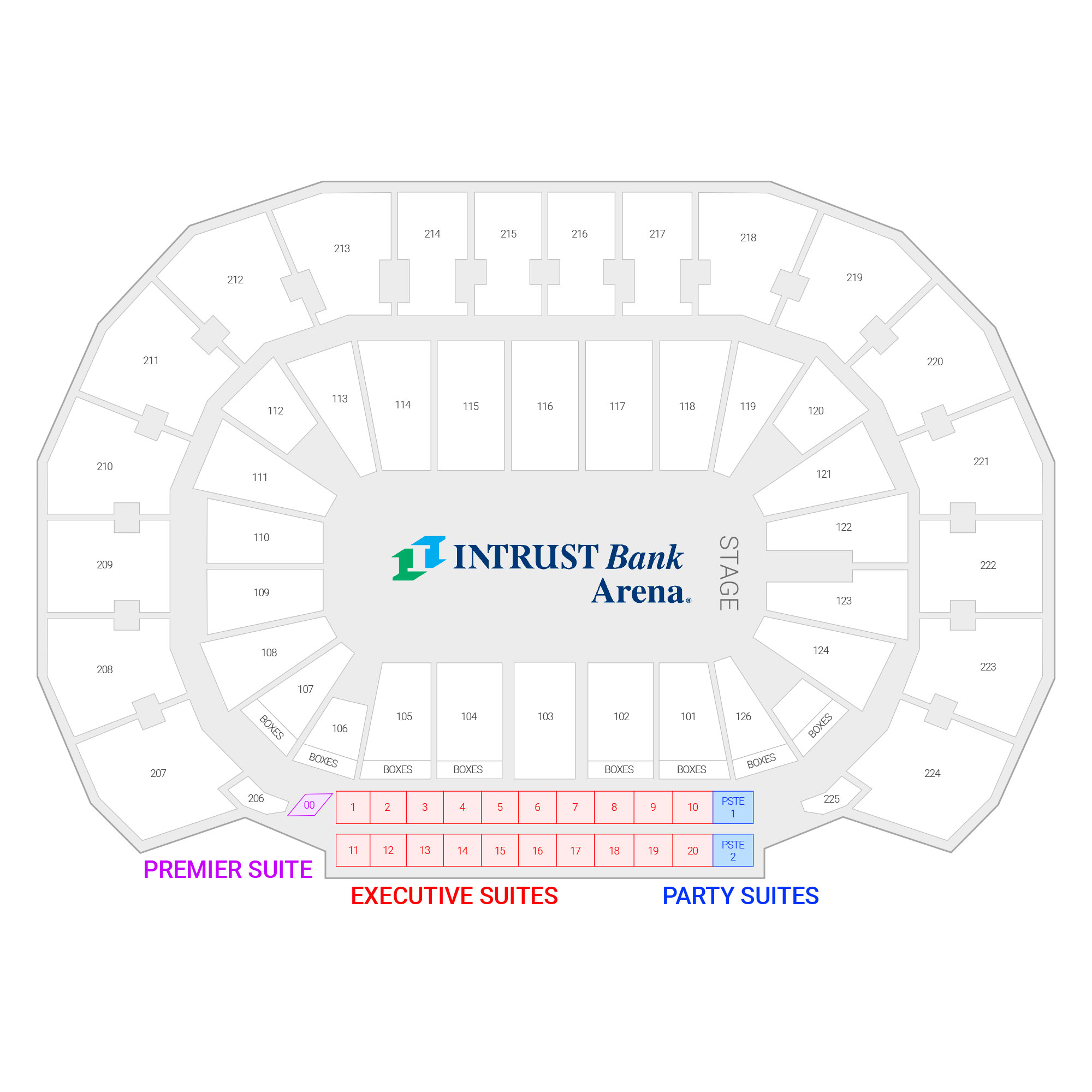

INTRUST Bank Arena

INTRUST Bank Arena

Explore Suites | INTRUST Bank Arena Suites